- Humana Colonoscopy Policy

- Copay For Colonoscopy With Humana

- Humana Screening Colonoscopy Guidelines

- United Healthcare Colonoscopy Copay

- Humana Copay Colonoscopy Coverage

Why was my colonoscopy so expensive?

Mention colonoscopies to most people, and they wince.

Humana National POS 10 Copay plans 100/70 copay plan 90/60 copay plan 80/50 copay plan Plan pays for services from PARTICIPATING providers Plan pays for services from NONPARTICIPATING providers Plan pays for services from PARTICIPATING providers Plan pays for services from NONPARTICIPATING providers Plan pays for services from PARTICIPATING providers. How much you can expect to pay out of pocket for a colonoscopy, including what people paid. For those not covered by health insurance, the cost of colonoscopy varies by provider and geographic region, usually ranging from $2,010 to $3,764, with an average of $3,081.

It's not just that the procedure is uncomfortable. Or that it could uncover some bad news. Or that the preparation for it — the fasting, the nasty preparation formula — makes people miserable.

No, people also dislike colonoscopies because they can be expensive.

For the uninsured, costs are particularly high. But even for many people with insurance, out-of-pocket costs can easily run into the thousands for a single procedure.

Maybe you're confused. You might think that colonoscopies are the poster-boy for preventive screenings. Of course they're covered by insurance.

You'd be right, for the most part. By law, insurers have to cover routine colonoscopies, without any costs passed on to the patients, so long as the patient is over 50, or has some specific cause to examine the colon.

But, as with so much else in healthcare, some conditions apply. And as one CoPatient customer found out, falling through the coverage cracks can lead to some eye-popping bills.

Here's their story, and what you can do to make sure it doesn't happen to you.

A $3100 coding mistake

It all started with a clerical error.

Because of a family history of colon problems, a young adult patient went in for a colonoscopy. Although the patient was under 50, they were assured that their family problems meant the procedure would be covered.

Humana Colonoscopy Policy

However, the specialist who performed the procedure made a mistake. On the patient's paperwork, the specialist put 'routine screening' instead of 'family history' for the primary diagnosis.

It seems like a small thing. But it resulted in a big bill for the patient.

Since insurance doesn't cover routine screenings for those under 50 years old, the patient's claim was denied. All charges for the services were sent directly to them.

On the whole, the patient was on the hook for over $2900.

Enter: CoPatient Billing Advocate Mindy Buss.

She fought hard for the patient, making phone calls, drafting appeal letters, even getting the patient's primary care doctor to write up a letter explaining why the colonoscopy was medically necessary.

In the end, her efforts worked. Not only did insurance end up covering the bill, the patient got a $200 refund back. More than $3100 saved!

This particular story has a happy ending. But it raises all kinds of questions about the way we pay for colonoscopies.

If a patient with a legitimate medical necessity had to hire professional help to fight an unfair bill, what does that mean for the rest of us? How can we make sure this kind of surprise bill doesn't come our way?

'Preventive' vs 'Diagnostic'

The most important thing to understand is where the law protects you, and where it doesn't.

Covered: Preventive Colonoscopies

Your insurance must cover the entire cost of your colonoscopy if:

- The main purpose of the test is to screen for cancer, and…

- …you're over 50, but younger than 75

OR

- …you have certain conditions that put you at high risk for colon cancer, like inflammatory bowel disease or, as in the story of Mindy's client, a family history of cancer.

These colonoscopies are called 'preventative' or 'screening' colonoscopies. As long as you get them under the above conditions, they're covered. Your insurance entitles you to one every 10 years.

Even if the doctor discovers and removes a polyp during your preventative colonoscopy, it's still considered preventative. So that removal is covered, too.

Might not be covered: Diagnostic Colonoscopies

The law has less to say about 'diagnostic' colonoscopies.

If, for example, you get a colonoscopy, and the doctor doesn't like what they saw, they can order you to be on the colonoscopy fast-track — getting, say, one every 3 years, instead of every 10. Those ‘extra' colonoscopies are diagnostic.

Or, if you're getting a colonoscopy for a reason other than cancer, those are diagnostic, too.

And these diagnostic procedures aren't always covered by insurance. Not every insurer will refuse to pay for them, but some certainly will. In fact, patients with high-deductible health plans can be on the hook for the entire bill.

Not just the tube

That's not the only wrinkle when it comes to colonoscopy billing.

As with most healthcare services, there's a whole team behind every colonoscopy:

- The doctor who performs the procedure;

- The facility where it takes place;

- The anesthesiologist who puts you under for it;

- The labs who examine any tissue samples;

- And the pharmacy who gives you that nasty preparation gunk.

More often than not, each of these providers is going to bill you separately.

Which means, if you're getting a diagnostic colonoscopy, and one of these providers isn't in your insurance network — it could really cost you.

As crack healthcare journalist Libby Rosenthal found, those out-of-network charges can bring a colonoscopy bill to the low five figures.

So what should you do?

Nobody wants a bill that big. How can patients protect themselves?

We asked Mindy what she thinks anyone who needs a colonoscopy should do.

1 - Know if it's preventative — and be prepared to prove it

You win if your insurer covers the entire colonoscopy. For that to happen, the colonoscopy has to fit in the 'preventative' category above.

A $3100 coding mistake

It all started with a clerical error.

Because of a family history of colon problems, a young adult patient went in for a colonoscopy. Although the patient was under 50, they were assured that their family problems meant the procedure would be covered.

Humana Colonoscopy Policy

However, the specialist who performed the procedure made a mistake. On the patient's paperwork, the specialist put 'routine screening' instead of 'family history' for the primary diagnosis.

It seems like a small thing. But it resulted in a big bill for the patient.

Since insurance doesn't cover routine screenings for those under 50 years old, the patient's claim was denied. All charges for the services were sent directly to them.

On the whole, the patient was on the hook for over $2900.

Enter: CoPatient Billing Advocate Mindy Buss.

She fought hard for the patient, making phone calls, drafting appeal letters, even getting the patient's primary care doctor to write up a letter explaining why the colonoscopy was medically necessary.

In the end, her efforts worked. Not only did insurance end up covering the bill, the patient got a $200 refund back. More than $3100 saved!

This particular story has a happy ending. But it raises all kinds of questions about the way we pay for colonoscopies.

If a patient with a legitimate medical necessity had to hire professional help to fight an unfair bill, what does that mean for the rest of us? How can we make sure this kind of surprise bill doesn't come our way?

'Preventive' vs 'Diagnostic'

The most important thing to understand is where the law protects you, and where it doesn't.

Covered: Preventive Colonoscopies

Your insurance must cover the entire cost of your colonoscopy if:

- The main purpose of the test is to screen for cancer, and…

- …you're over 50, but younger than 75

OR

- …you have certain conditions that put you at high risk for colon cancer, like inflammatory bowel disease or, as in the story of Mindy's client, a family history of cancer.

These colonoscopies are called 'preventative' or 'screening' colonoscopies. As long as you get them under the above conditions, they're covered. Your insurance entitles you to one every 10 years.

Even if the doctor discovers and removes a polyp during your preventative colonoscopy, it's still considered preventative. So that removal is covered, too.

Might not be covered: Diagnostic Colonoscopies

The law has less to say about 'diagnostic' colonoscopies.

If, for example, you get a colonoscopy, and the doctor doesn't like what they saw, they can order you to be on the colonoscopy fast-track — getting, say, one every 3 years, instead of every 10. Those ‘extra' colonoscopies are diagnostic.

Or, if you're getting a colonoscopy for a reason other than cancer, those are diagnostic, too.

And these diagnostic procedures aren't always covered by insurance. Not every insurer will refuse to pay for them, but some certainly will. In fact, patients with high-deductible health plans can be on the hook for the entire bill.

Not just the tube

That's not the only wrinkle when it comes to colonoscopy billing.

As with most healthcare services, there's a whole team behind every colonoscopy:

- The doctor who performs the procedure;

- The facility where it takes place;

- The anesthesiologist who puts you under for it;

- The labs who examine any tissue samples;

- And the pharmacy who gives you that nasty preparation gunk.

More often than not, each of these providers is going to bill you separately.

Which means, if you're getting a diagnostic colonoscopy, and one of these providers isn't in your insurance network — it could really cost you.

As crack healthcare journalist Libby Rosenthal found, those out-of-network charges can bring a colonoscopy bill to the low five figures.

So what should you do?

Nobody wants a bill that big. How can patients protect themselves?

We asked Mindy what she thinks anyone who needs a colonoscopy should do.

1 - Know if it's preventative — and be prepared to prove it

You win if your insurer covers the entire colonoscopy. For that to happen, the colonoscopy has to fit in the 'preventative' category above.

And it'd better be on record as a preventative colonoscopy.

We've harped on the importance of documentation before, but this time we really mean it.

Before you go to get your colonoscopy, talk to your primary doctor and make sure they document everything correctly. Get your age right, or any colon conditions, or any disconcerting family history.

These need to appear in your health record, or you could end up getting an expensive diagnostic colonoscopy by mistake.

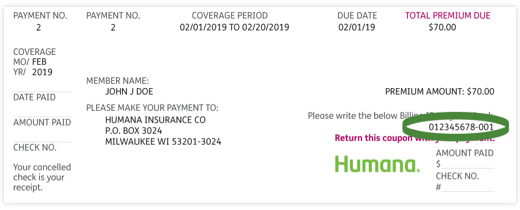

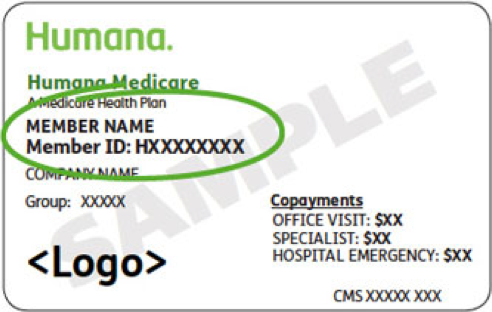

Copay For Colonoscopy With Humana

2 - Make sure all the care is in-network

Another point we've made before, but bears repeating. Whatever care you get, try to get it from providers within your insurance network. That, after all, is what's going to have the biggest effect on your bottom line.

In the case of colonoscopies, don't settle for getting an in-network gastroenterologist. Make sure the facility's in network, too. And the pathology lab. And the anesthesiologist (especially the anesthesiologist).

This may require a few painful phone calls with your provider and / or your insurer. But your wallet will thank you for the effort.

3 - If it won't be covered, shop around

For some patients, getting the colonoscopy covered just isn't in the cards. That doesn't mean there's nothing they can do.

If you need a diagnostic colonoscopy, you'll be paying quite a bit out of pocket. It's worth your while to shop around. Rates for a colonoscopy can vary wildly — from $600 to $5400, depending on the city.

That's a great profit from just a little bit of research.

Price transparency tools are your friend. And generally, ambulatory surgery centers (ASCs) will be cheaper than hospitals, so they'd be a good place to start.

Humana Screening Colonoscopy Guidelines

If all else fails…

Finally, if you've done all you can and still find yourself facing an outrageous colonoscopy bill, we can help.

United Healthcare Colonoscopy Copay

CoPatient has a big staff of dedicated advocates like Mindy ready to take your cause. Not every patient will save as much as her colonoscopy story, but we promise to fight for every penny you deserve. We'll help you make sense of your healthcare costs, and make sure your bill is as fair and accurate as possible.

Humana Copay Colonoscopy Coverage

So if your bills are too big to pay, or too confusing to understand — don't pay it! Reach out to us first. You may be able to save thousands off your healthcare costs.